Federal Reserve Watch: Securities Portfolio Down $233 Billion

bagi1998

The Federal Reserve continued to see the size of its securities portfolio shrink.

As of October 29, 2022, the Federal Reserve’s holdings of securities have decreased by $232.5 billion compared to March 16, 2022, when the Fed launched its current quantitative measures program. contraction.

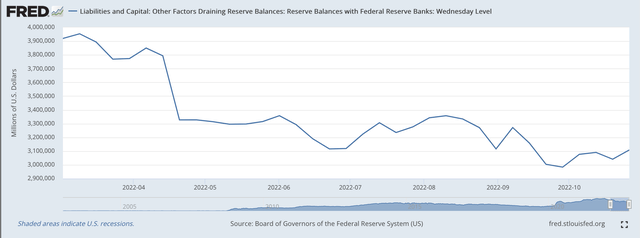

Reserve balances with Federal Reserve banks have fallen by $785.3 billion since March 16.

Most of the decline in reserve balances stems from the increase in reverse repurchase agreements. Reverse repurchase agreements have fallen by $624.8 billion since March 16.

Reverse repurchase agreements are transactions in which the Federal Reserve sells securities under an agreement to repurchase the securities at the end of the term of the agreement, which can be overnight, day, two days or more.

I write that reverse repurchase agreements have decreased by $624.8 billion since March 16, 2022.

This number is obtained by taking the end-of-day balance of reverse repurchase agreements from the Fed’s balance sheet line, found in the Federal Reserve’s H.4.1 release titled “Factors Affecting Reserve Balances of Depository Institutions and Condition” . Federal Reserve Bank Statement.” The first item in the release is titled “Factors Affecting Reserve Balances of Depository Institutions.” This release presents the balance sheet of the Federal Reserve.

As of the close of business on March 16, 2022, the Federal Reserve reported that the end-of-day balance of reverse repurchase agreements on the Fed’s balance sheet was $1.864.6 billion.

As of the close of business on October 29, 2022, the reported balance for reverse repurchase agreements was $2,489.4 billion. Taking the difference between these two balances, we get the $624.8 shown above.

Regardless of the maturity of the repurchase agreements, the total carried on the balance sheet is the amount that balances the balance sheet at the close of business on Wednesday evening. It is a real number.

Fed Policy Stance

The Federal Reserve is trying to bring real inflation back to its policy target of 2.0%.

The Federal Reserve tries to achieve this result by raising its key interest rate and reducing the amount of securities the Fed carries on its balance sheet.

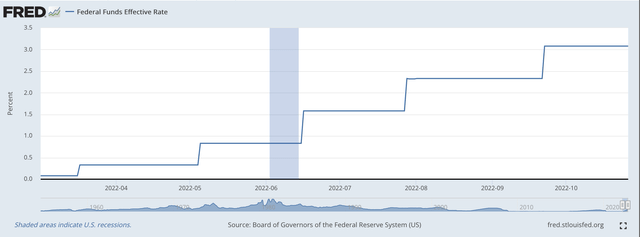

Prior to March 16, the Fed’s key interest rate, the effective federal funds rate was 0.08%.

Effective Federal Funds Rate (Federal Reserve)

There have been five increases in the effective federal funds rate since the March 16 meeting of the Federal Open Market Committee.

There is another meeting of the Federal Open Market Committee next Tuesday and Wednesday, November 1 and 2, and the FOMC is expected to raise the effective federal funds rate by another 75 basis points.

There will be another FOMC meeting this year in December and the FOMC is expected to raise its key interest rate by at least another 50 basis points.

To achieve and sustain these increases in its key interest rate, the Fed is reducing the amount of liquidity that exists in the banking system.

This is why the Federal Reserve allows securities to mature from its portfolio of securities bought in a hurry.

As mentioned above, since March 16, $232.5 billion of securities have left the Fed’s balance sheet.

As mentioned above, reverse repurchase agreements represent sales of securities by the Federal Reserve. But, the fact that the sale is tied to a repurchase of the securities means that the reverse repurchase agreements are a liability of the Fed, and the securities sold by the Fed do not leave the securities portfolios.

However, this liability represents a reduction in the amount of securities that are counted as an outright purchased security, an asset, on the Fed’s balance sheet.

The use of reverse repurchase agreements helps the Fed manage liquidity in the commercial banking system.

In other words, if there are not enough securities leaving the Fed’s securities portfolio, the Fed can manage the amount of reverse repurchase agreements on its balance sheet to control the amount of cash that is in the system. bank and can support the level of the federal workforce The funds rate is now controlled by the Federal Reserve.

Reserve balances with Federal Reserve Banks (Federal Reserve)

Note how these reserve balances with the Federal Reserve Banks have steadily declined with the decline in the effective federal funds rate.

But the Federal Reserve wants to continue to keep the amount of securities on its balance sheet down.

Currently, the Fed is using the approach called “quantitative tightening”.

Quantitative tightening occurs when the Fed steadily reduces the size of its balance sheet on a regular basis. When the Fed initially communicated the parameters for quantitative tightening, it signaled that it wanted to remove up to $95.0 billion of securities from its portfolio each month and that it wanted to continue doing so through 2024.

Currently, the Fed is nowhere near that total. But, he is reducing the size of his wallet every month.

This “quantitative tightening” is reminiscent of the policies previously followed by Fed Chairs Ben Bernanke and Jerome Powell.

Mr. Bernanke, during his tenure at the Fed, oversaw three rounds of quantitative easing as the Fed injected funds into the banking system to support rising stock prices and rising consumer spending.

Mr. Bernanke has had great success.

Mr. Powell, in the spring of 2020, in order to combat the threat of the collapse of the American financial and economic system, oversaw the creation of another quantitative easing program, this time with the purchase by the Fed of 120 billion dollars worth of securities for his portfolio for a few months. 18 months.

Mr. Powell avoided a collapse of the American financial system or the American economy.

Thus, the quantitative tightening program is in line with what the Fed has been doing for a decade, before 2020.

Two questions

There are, however, two questions that remain unanswered.

First, how far will the Federal Reserve take interest rates?

Second, how much cash is the Federal Reserve going to take out of the banking system.

If the Federal Reserve raises its key rate by 75 basis points next week and by 50 basis points at the December FOMC meeting, the effective federal funds rate will rise to 4.33%.

Some analysts have said they believe the Fed will raise the key interest rate above 5.00%.

Many market participants believe that the 5.00% level is a bit high.

As for the shrinking Fed balance sheet, the Fed’s holdings of securities now total $8.3 trillion.

Earlier Fed statements on the reduction of the Fed securities portfolio indicated that the Fed hopes to reduce the portfolio to approximately $6.0 trillion.

It would be quite a movement.

But would that be enough?

And what about reducing the amount of reverse repurchase agreements on the balance sheet?

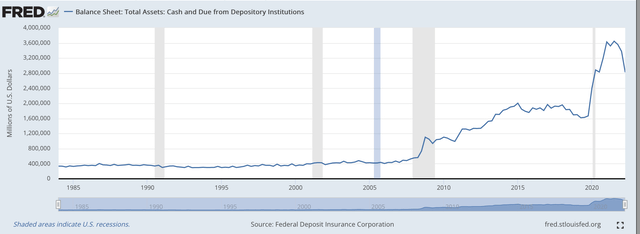

Commercial banks now have $2.8 trillion in cash on their balance sheets. As can be seen in the attached table, this amount of “cash” has been accumulated over several years.

But (and this is the reason for the extended time chart) banks have not always been such money hoarders. This “hoarding” has only happened in recent years.

Cash holdings with commercial banks (Federal Deposit Insurance Corp.)

However, the picture that is shown indicates that the commercial banking sector has lots and lots of liquidity.

Thus, the Fed’s efforts to reduce liquidity in the banking system may require more action from the Fed than currently expected.

Much remains to be done to straighten out the commercial banking system.

Comments are closed.