Alphabet: cash flow machine with fortified balance sheet (GOOG) (GOOGL)

Sean Gallup

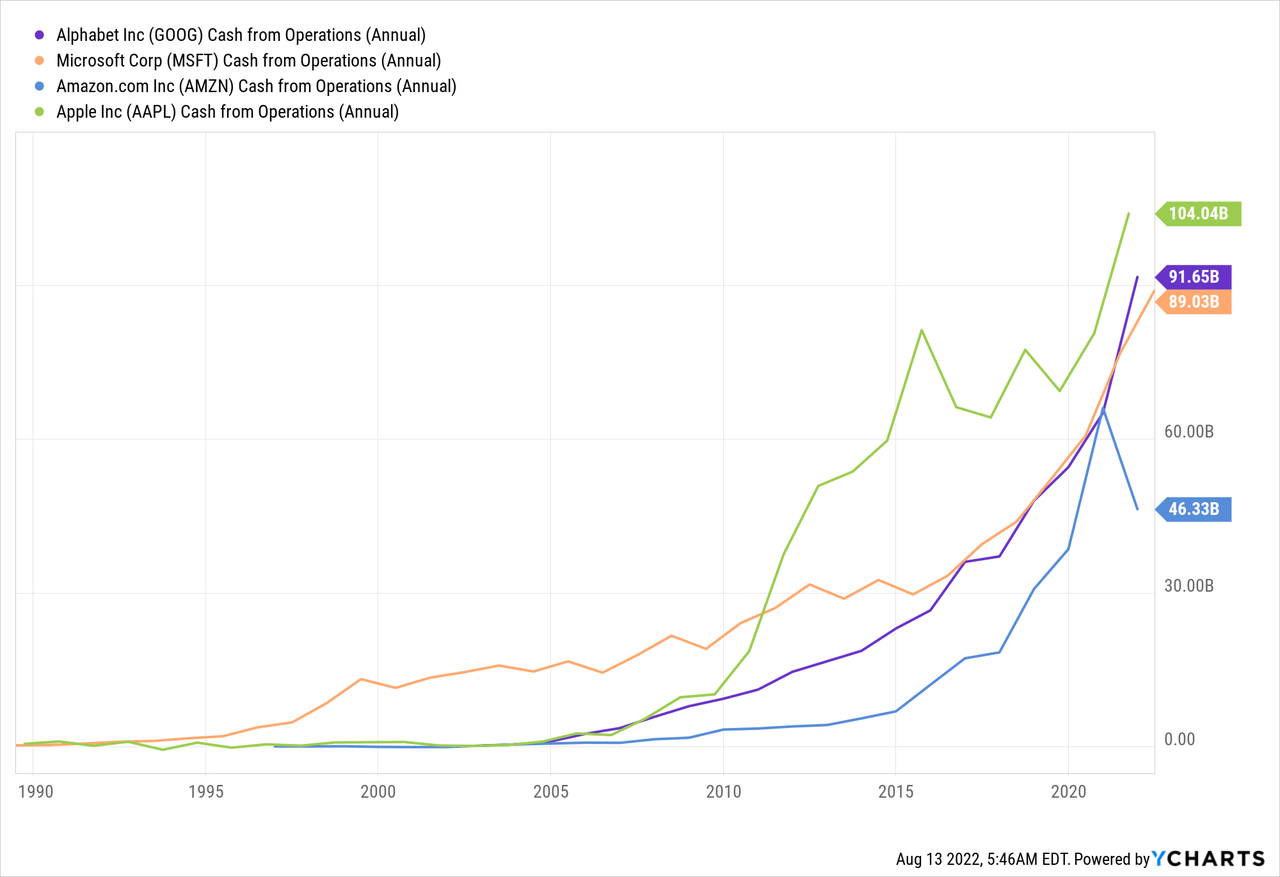

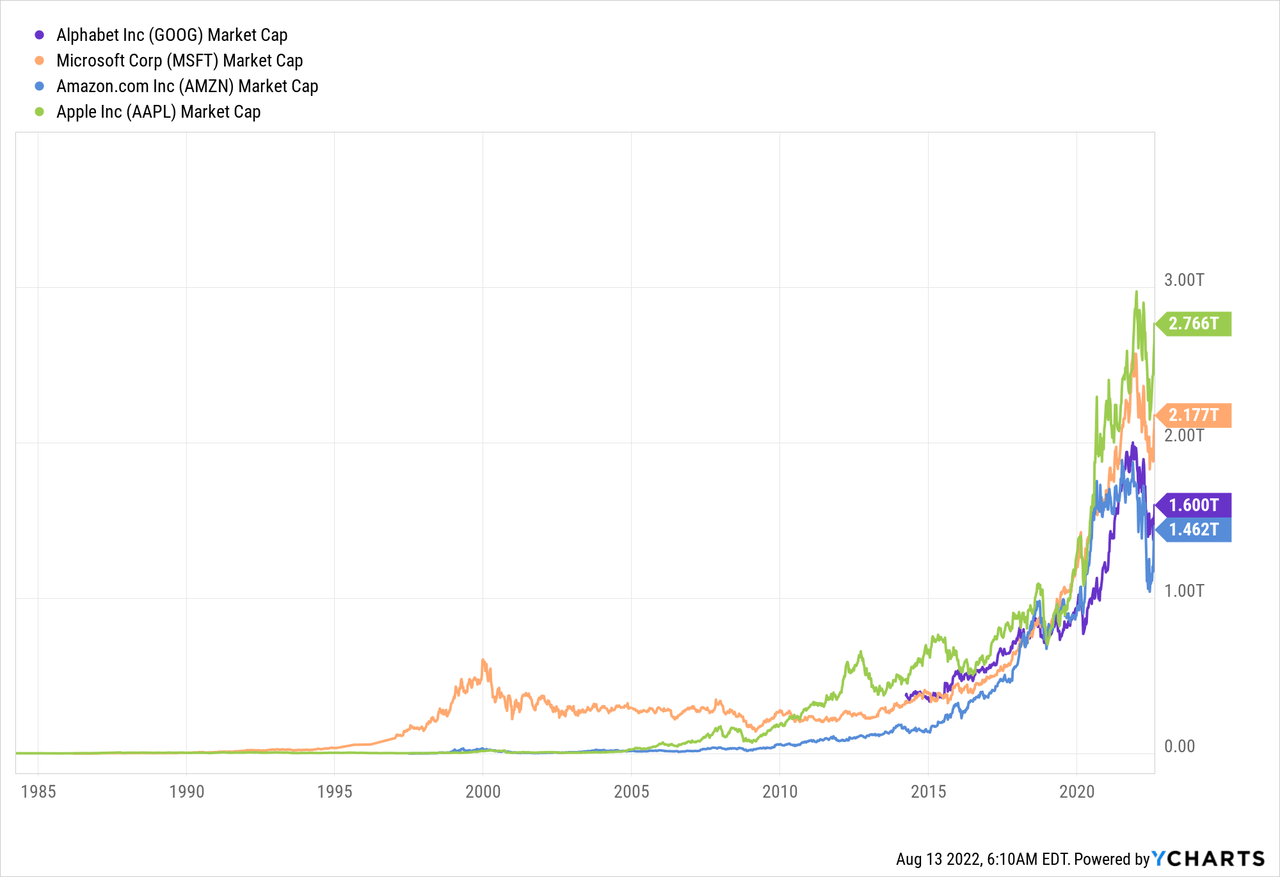

Just a few years ago, we were in the race to find out which company would reach a trillion dollar market capitalization for the first time. Now we have several multi-trillion dollar companies. It’s no surprise that the trillion dollar club is dominated by US tech giants from the love Apple (AAPL), Microsoft (MSFT), Amazon (AMZN) and Alphabet (NASDAQ:GOOG) (NASDAQ: GOOGL). These tech giants have the following things in common; 1) they generate insane, eye-popping cash flow from operations and 2) they have rock-solid balance sheets awash with cash. Alphabet, Google’s parent company, is arguably the cheapest of the aforementioned tech companies (more on that below).

First of all, it is important to underline the stability of Alphabet’s results, especially since we are going through a very turbulent period, with skyrocketing inflation, aggressive interest rate hikes, COVID-19 and geopolitical tensions, including the war in Ukraine and escalation. between China and Taiwan, among others. Alphabet, recently announced strong results for the second quarter of 2022. Revenue was $69.7 billion, up 13% from a year ago. That said, the results slightly exceeded estimates and this is the slowest quarterly growth in two years. Clearly, the tailwinds enjoyed by big tech companies during the pandemic are no longer there. Despite the slowdown, Alphabet remains extremely profitable. Net income was $16 billion for the period, or $1.21 per share, down 14% from a year ago ($18.53 billion or $1.27 per share). stock). Performance was mainly driven by search and cloud. As Sundar Pichai, CEO of Alphabet and Google commented:

In the second quarter, our performance was driven by search and cloud. The investments we’ve made over the years in AI and IT help make our services particularly valuable to consumers and highly effective for businesses of all sizes. As we refine our focus, we will continue to invest responsibly in deep computing for the long term.

As the saying goes, “cash is king”. So far this year, Alphabet is showing tremendous resilience on the two important metrics that really matter, namely 1) net cash provided by operating activities and 2) cash and cash equivalents. Specifically:

- For Q2 2022, net cash provided by operating activities was $19.4 billion

- Based on a TTM period (latest 12 months), net cash provided by operating activities is a record $95 billion

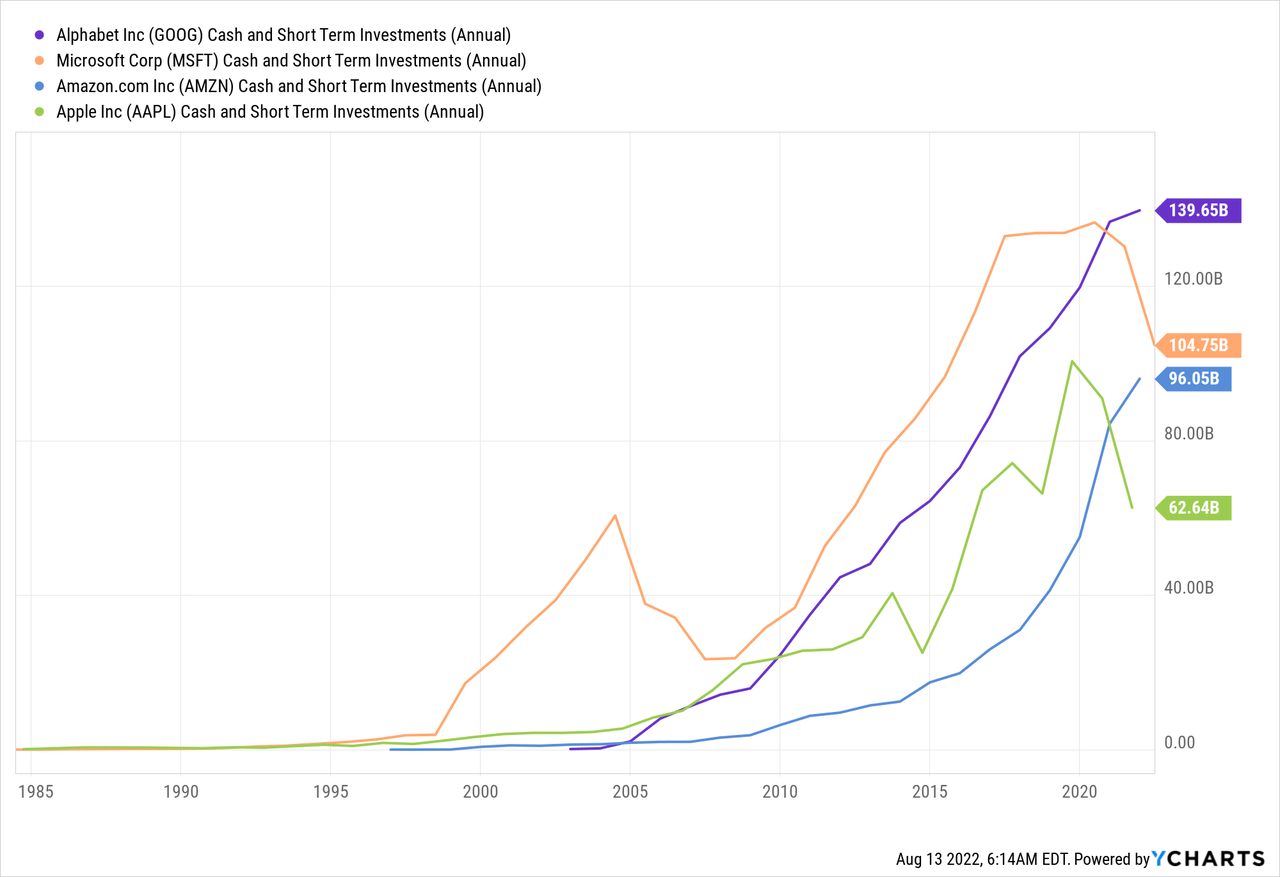

- As of June 30, total cash and cash equivalents, including marketable securities, were $125 billion.

The fact that Alphabet does not pay a regular dividend, unlike Microsoft and Apple, provides additional financial flexibility. Dividends paid by blue chip companies are usually fixed and progressive in nature, which means that it is a constant cash outflow. Instead, Alphabet shareholders are compensated in the form of share buybacks, which is a more flexible arrangement. As such, if Alphabet decides it wants to hoard cash, for whatever reason (for example, to acquire another company), it can be done in the blink of an eye, effectively following a “ light switch”, i.e. by reducing takeovers or by reducing on R&D (Research and Development). Either way, generating around $95 billion a year in operating cash flow (which is basically a recurring event every year – a gift that keeps on giving) and having around $125 billion in cash , which can be increased by following the “light switch” approach, as discussed above, basically means that Alphabet can do whatever it wants.

As mentioned above, Alphabet is arguably the cheapest of the aforementioned tech companies, at least in terms of cash from operations versus market cap, which I think is the most telling metric. As the chart below illustrates, prior to 2010 Alphabet was starting from a lower base in terms of operating cash than Apple and Microsoft, but is catching up at an impressive rate and, if that rate continues, it will soon dominate the market. countryside.

Alphabet overtook Microsoft in 2021 and is now flirting with the top spot, currently held by Apple, which generates more than $100 billion in operating cash. My bet is that Alphabet will continue to enjoy above-average growth rates against its peers, all else held constant, and comfortably top the $100 billion mark, helped by the dominant search engine Google and a wide range of other popular services including Gmail, Chrome web browser, Google Maps, YouTube and Android smartphone software.

Additionally, in terms of balance sheet strength, Alphabet ranks high in terms of cash and short-term investments (i.e. marketable securities).

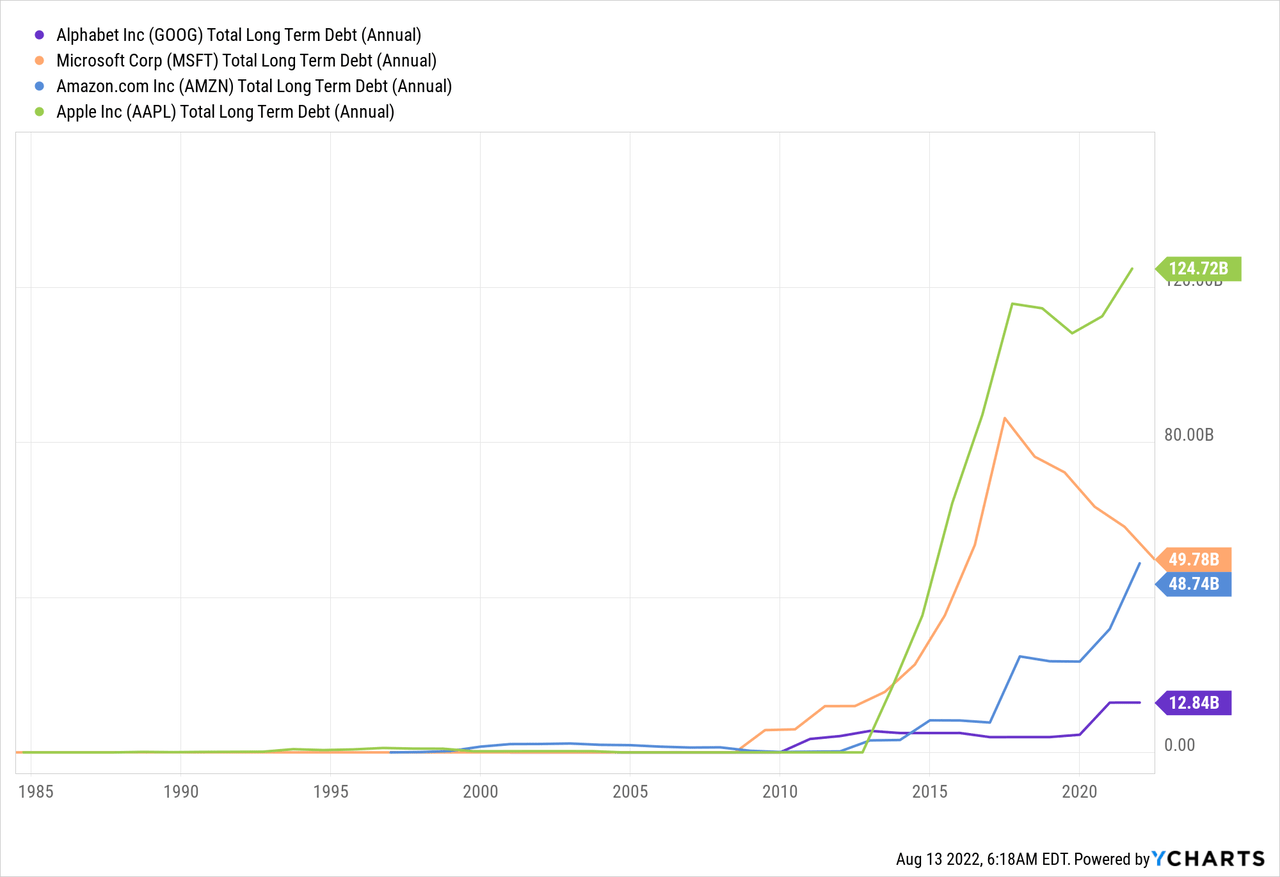

That said, it’s important to note that we’re not comparing apples to apples. Apple classifies more than $130 billion in marketable securities as long-term investments (non-current assets). So to be fair, you have to add that number to Apple’s total cash balance, because it’s liquid assets, which means that Apple is effectively overtaking Alphabet on that front, registering almost $200 billion. in cash and negotiable securities. However, in terms of total long-term debt, Apple leads the pack by a wide margin, with nearly $125 billion in debt – which essentially offsets the $130 billion in marketable securities classified as long-term investments. .

Of particular interest, Alphabet has by far the lowest total debt. In other words, if its cash and cash equivalents are also taken into account, Alphabet objectively has the strongest balance sheet. In fact, Alphabet is the only tech giant where Cash & Short Term Investments exceed all debts (i.e. not only total short and long term debt, but also accounts payable, deferred revenue, accrued liabilities, operating lease obligations, etc.).

In short, Alphabet has the strongest balance sheet and generates almost as much operating cash as Apple (having recently overtaken Microsoft and left Amazon behind by a wide margin). And, taking into account Alphabet’s growth prospects from its world-class products, one would expect Alphabet’s market capitalization to lead the way, or at least be comparable to Apple and Microsoft. However, this is not the case. Not even close.

Paradoxically, Alphabet’s market capitalization is similar to that of Amazon, $1 trillion less than Apple and nearly $600 billion less than Microsoft. And, as mentioned above, Alphabet has the strongest balance sheet and generates more operating cash than Microsoft, and almost as much as Apple. It’s a “headache” and I can only conclude that the market is either sleeping or assuming that Alphabet will struggle to grow in the future. But Alphabet is not a company that stays put. It will invest approximately $25 billion in R&D for fiscal 2022 (this is not already factored into the operating cash flow metrics). That’s a lot of money for annual R&D, and odds are something will pay off. Additionally, of the ~$95 billion in operating cash flow, approximately $25 billion will go to “goods and equipment purchases,” which includes both growth and maintenance CAPEX. As such, the remaining ~$70 billion is essentially free cash flow. That’s a lot of money, and as mentioned above, it’s a recurring item (meaning it recurs every year), but with some fluctuation.

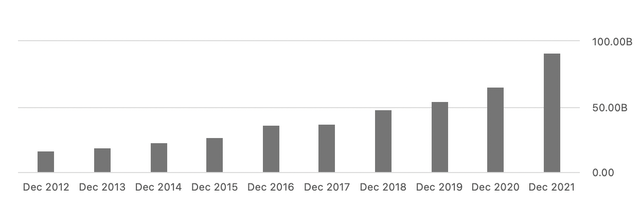

Importantly, Alphabet’s operating cash flow resilience and ability to hoard cash is not a recent phenomenon. In fact, it has been for over a decade. In addition to the charts above, I include the following bar charts to better illustrate this phenomenon.

Alphabet’s annual operating cash flow:

Looking for Alpha

In 2012, annual operating cash was just $16.7 billion. In 2019 it passed the $50 billion mark, in 2021 it passed $90 billion, and in a TTM period it is $95 billion. In other words, the annual operating cash flow has has increased more than 5 times since 2012, and we are now flirting with the $100 billion mark. This is a remarkable achievement for a company of this size. By comparison, Apple has “only” managed to double the cash flow of its operations over the past decade. Additionally, Alphabet’s cash balance also follows a similar pattern.

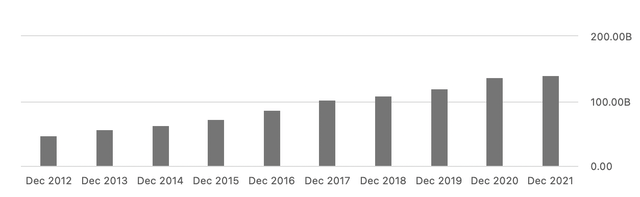

Alphabet’s total cash and short-term investments:

Looking for Alpha

In 2012, the cash balance (including marketable securities) was less than $50 billion, and according to the latest earnings report, it is now over $120 billion. In other words, Alphabet is in an extremely strong position and is able to survive in any type of environment.

I always like to stress test my investments, in an effort to be as conservative as possible. Let’s discuss the market’s pessimistic view that Alphabet will not grow at all in the next few years. To this end, I assume the following scenario:

- 10 year investment horizon

- Consistent annual run rate of $90 billion in operating cash flow (based on 2021 numbers and below TTM figure of approximately $95 billion)

- Static world: meaning that annual operating cash flow will remain constant at $90 billion, and this cash flow will not be reinvested, i.e. it will simply accumulate on the balance sheet ( i.e. there will be no investment outraged Maintenance CAPEXzero innovation, zero M&A, zero share buybacks, zero dividends, etc.)

In this scenario, over a 10-year period, Alphabet will accumulate more than $750 billion in cash, or about 50% of its current market capitalization. This provides a huge margin of safety, but it’s also far too pessimistic and extreme a scenario, in my opinion. In reality, Alphabet will innovate, grow as a business, either organically or by acquiring other companies, buying back shares, and ultimately EPS will be well above current levels. Patient and long-term investors will benefit immensely. Unless Alphabet products such as Google, Gmail, Google Maps, etc. do not become obsolete. What are the chances? Extremely weak in my opinion.

Comments are closed.